In a significant recalibration of the prevailing discourse surrounding trans-Pacific trade, Stephan Tanda, the Chief Executive Officer of Aptargroup, has suggested that Western projections regarding Chinese economic vulnerability may be fundamentally flawed.

Following an extensive professional engagement within the region, Tanda argues that the Chinese industrial sector remains largely undeterred by the impending implementation of substantial U.S. tariffs. He attributes this resilience to a collective industrial resolve and a pervasive “willpower” that he characterizes as being on an entirely different scale than that observed in Western markets.

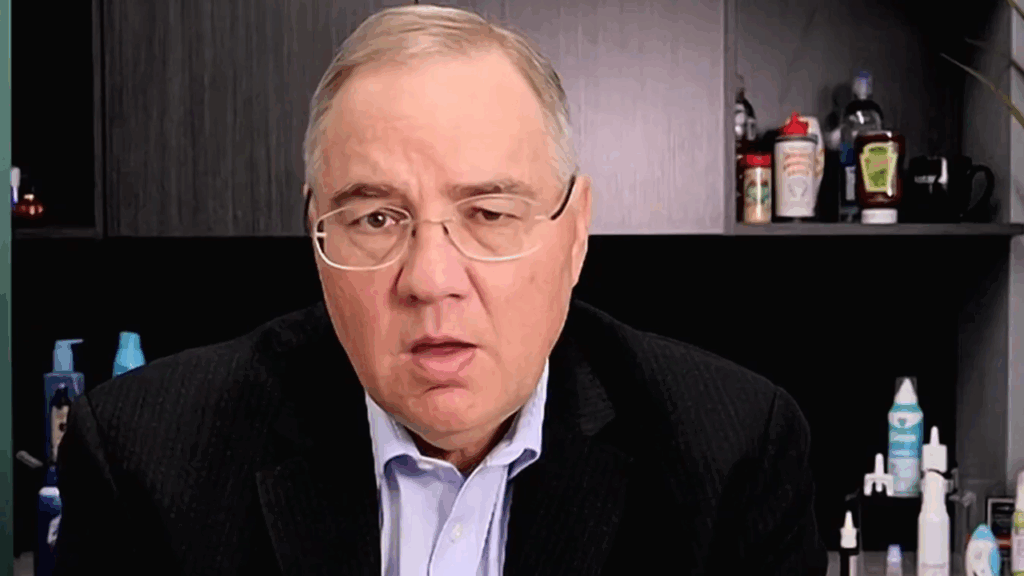

AptarGroup CEO believes China stands tall against US tariffs

According to a Fortune report, AptarGroup CEO Stephen Tanda shared his views on US President Donald Trump’s tariffs on China. Tanda believes that the tariffs will not have any dire impact on the country in the foreseeable future. The analysis provided by Tanda, whose firm is a preeminent global leader in drug delivery and consumer dispensing solutions, moves beyond mere macroeconomic modeling to address the cultural and operational ethos of the Chinese workforce.

While international observers often focus on the potential for a 60% tariff to destabilize the second-largest economy in the world, Tanda suggests such metrics fail to account for the extraordinary agility of the Chinese private sector. He describes a pervasive determination that permeates every level of production, from executive leadership to the factory floor. This psychological fortitude appears to be a systemic constant, shielding the industrial base from the volatility typically associated with shifting geopolitical climates.

This industrial fortitude is manifesting in highly sophisticated strategic pivots that prioritize long-term dominance over short-term reactionary measures. Rather than succumbing to the pressure of protectionist policies, Chinese firms are rapidly diversifying their supply chains and accelerating the “China plus one” strategy, expanding their manufacturing footprint into neutral territories such as Southeast Asia and Mexico to effectively bypass trade barriers.

Furthermore, Tanda observed a relentless drive toward domestic self-reliance and technological integration that defies traditional Western timelines. The speed with which these organizations scale and optimize production suggests that tariffs are perceived not as terminal threats, but as surmountable logistical challenges to be addressed through superior efficiency and innovative redirection.

The implications for U.S. trade policy are potentially unsettling for proponents of aggressive economic decoupling. If Tanda’s assessment is accurate, the intended coercive power of tariffs may be blunted by an adversary that thrives under external pressure and views adversity as a catalyst for systemic improvement.

Related: NVIDIA CEO Jensen Huang Commends U.S. President Donald Trump for Saving AI Industry

Stephen Tanda throws light on technological innovations in China

Additionally, Tanda notes that the integration of automation and artificial intelligence within Chinese facilities has reached a level of sophistication that ensures competitive pricing even when factoring in the increased costs of market entry.

This technological leap, combined with a workforce that displays an almost existential commitment to national economic success, creates a formidable barrier against Western efforts to re-shore manufacturing. The sheer scale of the Chinese willpower to maintain its status as the “world’s factory” suggests that the cost of displacement may be higher than many Western policymakers have publicly acknowledged.

Tanda’s observations serve as a sophisticated cautionary note for global policymakers and corporate strategists alike. By potentially underestimating the sheer willpower and adaptability of the Chinese industrial ecosystem, the West risks miscalculating the long-term trajectory of global market dominance.

For Aptargroup and its contemporaries, the primary takeaway from the current geopolitical climate is clear: in an era of unprecedented trade volatility, the most critical asset a nation or corporation can possess is the inexorable capacity to persevere through adversity. The narrative of the coming decade may not be defined by the height of protectionist walls, but by the ingenuity and grit of those tasked with navigating their shadows.

Also Read: Tesla CEO Elon Musk Envisions a Future Where AI Eradicates Poverty and Boosts Global Wealth