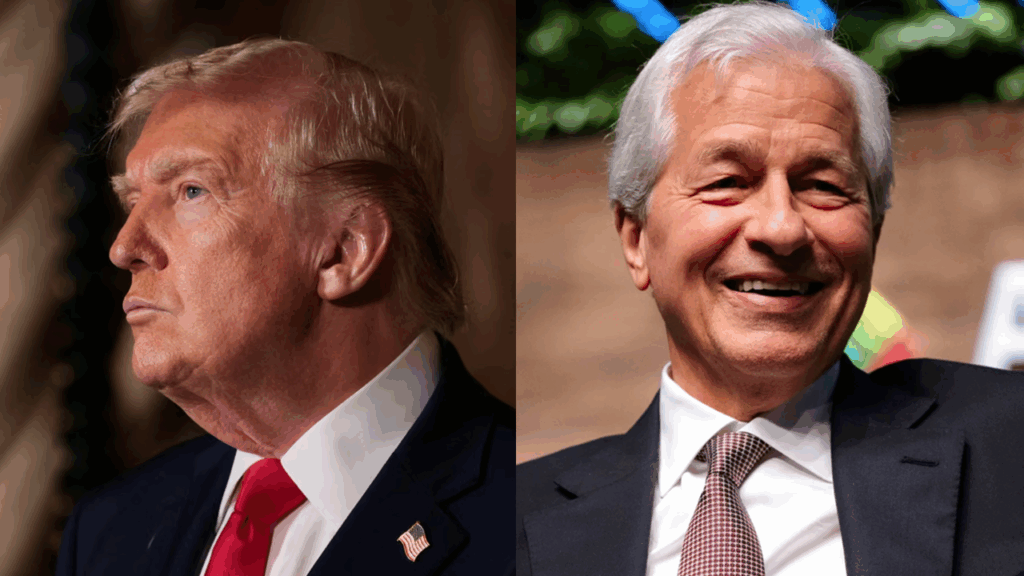

In a significant legal escalation that challenges the intersection of private commerce and political expression, President Donald Trump has initiated a $5 billion lawsuit against JPMorganChase, the nation’s largest financial institution.

The litigation, filed in a Florida court, also names the bank’s Chief Executive, Jamie Dimon, as a defendant, alleging that the firm engaged in an unlawful and politically motivated campaign to “debank” the President and his associated business entities following the events of January 6, 2021.

US President Donald Trump intends to JPMorganChase for $5 Billion

According to a recent BBC report, US President Trump is planning to sue JPMorganChase for a whopping $5 billion. The complaint asserts that the bank’s decision to abruptly terminate several long-standing accounts was not a routine exercise of internal compliance, but rather a coordinated act of discrimination. According to the filing, the President and his businesses suffered “considerable financial and reputational harm” after the bank moved to sever ties during the period in which supporters had descended on the U.S. Capitol.

President Donald Trump’s legal team contends that these actions were driven by “unsubstantiated, ‘woke’ beliefs” and a desire to distance the institution from conservative viewpoints, describing the move as a “key indicator of a systemic, subversive industry practice” intended to coerce the public into realigning their political affiliations.

Central to the $5 billion claim is the accusation of trade libel. The lawsuit alleges that JPMorganChase, with the purported approval of Mr Dimon, placed the President’s name, along with those of his family and businesses, on a “blacklist.” This roster was reportedly shared with other financial institutions and intended to identify individuals with a history of “malfeasant” activity, effectively creating a barrier to entry across the broader global financial landscape.

The filing argues that the bank leveraged its position of power to act as a political referee, concluding that the firm moved against the plaintiffs simply because it believed the “political tide at the moment favored doing so.”

In response, JPMorganChase has characterized the litigation as meritless. A spokesperson for the firm clarified that the bank does not close accounts for political or religious reasons, maintaining that such decisions are dictated by “rules and regulatory expectations” regarding the management of legal and regulatory risk.

The institution further expressed that it has previously appealed to multiple administrations to reform the very regulations that often place banks in the position of terminating client relationships, signaling a commitment to preventing the “weaponization” of the financial sector while remaining bound by current compliance frameworks.

How far could the Trump-JPMorganChase tussle go?

The timing of the lawsuit coincides with a period of heightened friction between the White House and the banking elite. Mr Dimon has recently been a vocal critic of the administration’s proposals, specifically opposing a suggested cap on credit card interest rates and expressing disapproval regarding the current posture toward the Federal Reserve and immigration policy.

By filing the complaint in Florida, a state that explicitly prohibits financial institutions from discriminating against clients based on political views, the President’s legal team has positioned the case within a jurisdiction that may prove pivotal for the “right to be banked.”

As the case moves forward, it highlights a broader national debate concerning the influence of large corporations over civil life. While JPMorganChase maintains its actions were necessitated by risk management protocols, the administration views the move as a dangerous precedent for corporate overreach. This legal confrontation stands to test whether the internal “risk assessments” of a private bank can be legally categorized as a form of illicit political censorship, potentially redefining the boundaries of corporate autonomy in the 21st century.

Also Read: President Trump Slams EU Commission’s “Nasty” Decision To Fine Elon Musk