Among the world’s “centibillionaires,” Jeff Bezos has refined the boundaries of wealth management. The Amazon founder is attempting to transform raw capital into a high-stakes display of ultra-luxury. While his professional tenure is defined by Amazon’s logistical dominance, his private life has evolved into a masterclass in strategic indulgence.

According to a GO BankingRates report, the cumulative valuation of Bezos’ personal “adventures,” spanning from the depths of Texan mountains to the orbital silence of the thermosphere, has surpassed an estimated $6.5 billion.

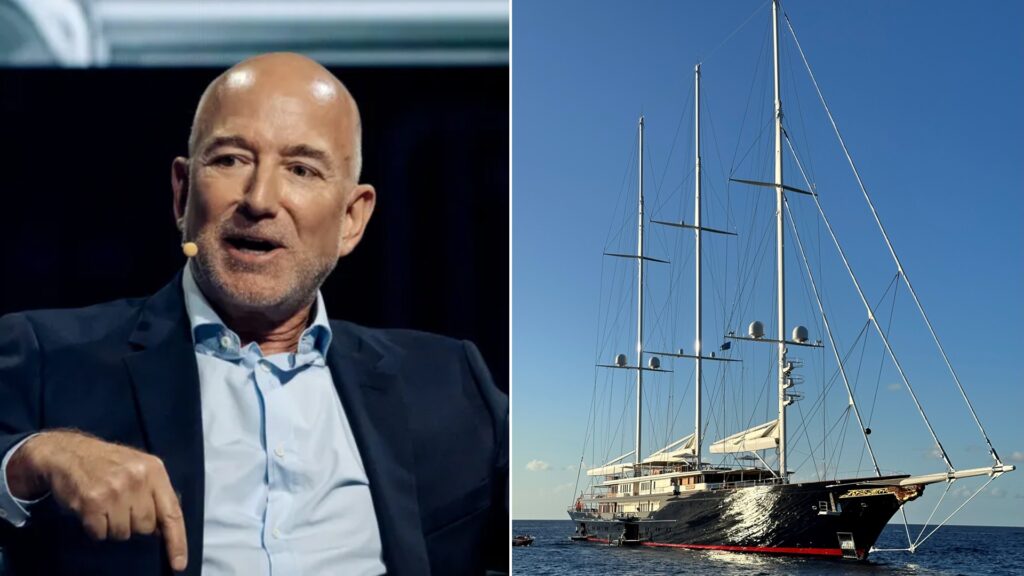

The Bezos’ Vessel – Koru

The most visible symbol of his prized possessions is the Koru, a 417-foot sailing yacht representing a $500 million foray into maritime history. Delivered by Dutch shipyard company Oceanco in 2023, the three-masted schooner is the world’s largest sailing vessel. Maintaining such a vessel is an economic feat in itself. Experts estimate annual operating costs between $25 million and $50 million to care for the Koru.

To address the limitations of a sailing vessel, Bezos invested in the building of the Abeona, a 246-foot “shadow vessel” valued at $100 million. This secondary vessel acts as a mobile logistics hub, housing a professional crew of 40 and a helipad for his wife, Lauren Sánchez. Recent sightings in St. Barts and the Mediterranean confirm the Koru has become a traveling venue for a global elite, hosting figures ranging from Bill Gates to Hollywood’s most protected A-listers.

Years Ticking – The Clock of the Long Now

While the Koru reflects a pursuit of leisure, the “Clock of the Long Now” represents an investment in temporal philosophy. Buried within a hollowed-out mountain on Bezos’ private ranch in the Sierra Diablo range, this $42 million mechanical marvel is designed to keep time for 10,000 years.

Engineered to tick just once a year, the clock is powered by the Earth’s thermal cycles and is intended to outlast current geopolitical structures. This monumental project is more than a curiosity; it is a deliberate effort to position Bezos as a guardian of “deep time,” aligning his legacy with the enduring artifacts of ancient civilizations.

Related: Jeff Bezos’ Most Expensive Bet That Still Makes No Money

Blue Origin and Bezos’s plans for Space Tourism

However, the most significant of Bezos’ expenditures remains his assault on the final frontier. His suborbital flight on Blue Origin in 2021 was a four-minute journey with a development cost exceeding $5.5 billion. As of early 2026, Bezos continues to liquidate approximately $1 billion in Amazon stock annually to fund the firm’s orbital and lunar ambitions.

The strategic pivot in January this month, pausing the New Shepard space tourism program to focus resources on the Blue Moon lunar lander and the New Glenn orbital rocket, indicates that Bezos has moved beyond the “adventure” phase into a serious bid for the commercialization of space.

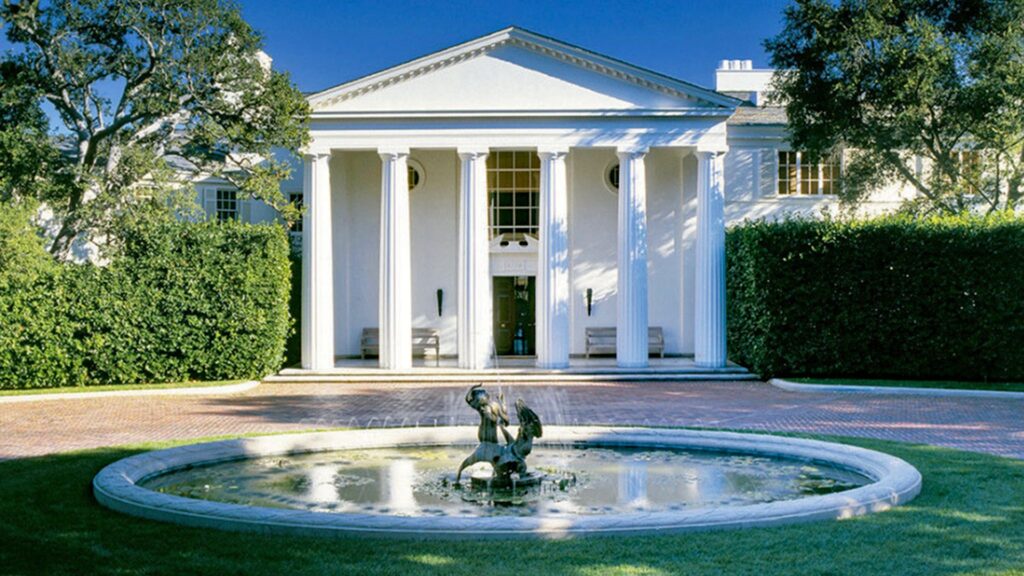

The Real Estate Empire of Jeff Bezos

On terra firma, Bezos’ appetite for record-breaking acquisitions has resulted in a real estate empire valued at over $600 million. His recent consolidation of a massive compound in Florida’s “Billionaire Bunker” (Indian Creek Island), where he has spent nearly $240 million on adjacent waterfront properties, highlights a transition toward a high-security, tax-efficient residency. His property in Beverly Hills is also worth noting.

To the casual observer, these expenditures may seem like the whims of the ultra-wealthy. To the market analyst, however, they represent the curation of a modern polymath’s legacy. From the $500 million yacht to the 10,000-year clock, each investment serves to cement a narrative that is as much about cultivating an extraordinary existence as it is about accumulating wealth.

As Bezos navigates the Caribbean or oversees the next launch at Cape Canaveral, the message is clear: for the founder of Amazon, the world is not merely a market to be dominated, but a canvas for the ultimate expression of permanence.

Also Read: The Truth Behind Khaby Lame’s $975 Million Deal and Why It’s Being Misunderstood