Amazon has broken Walmart’s sales record, ending the latter’s 13-year run at the top of the global retail revenue charts. The online retail giant recorded approximately $717 billion in sales in 2025, surpassing Walmart’s roughly $713 billion in the same year.

Notably, Amazon’s revenue does not come solely from retail sales. A significant portion is derived from advertising, cloud computing, and other business segments.

The growth of the company is remarkable considering that it started as an online bookstore in 1994. It later branched into e-commerce, retail, media and entertainment, cloud computing, and other sectors. Reportedly, it earned nearly $129 billion in revenue last year from its Amazon Web Services (AWS) division. Amazon’s e-commerce business, however, remains the largest contributor to total revenue.

Despite Amazon’s Recent Success, Walmart Is Still Going Strong

Amazon broke Walmart’s more than decade-long record, with its online and physical stores, as well as third-party seller services, remaining the largest contributors in terms of revenue. Furthermore, the company brought in more than $100 billion combined from advertising and Prime subscriptions.

However, the key profit driver in the latest financial quarter has been its AWS division, which provides storage, cloud computing, and artificial intelligence services to companies and governments worldwide. The division accounts for a disproportionately large share of operating income compared to its share of revenue.

Meanwhile, a large chunk of Walmart’s sales continues to come from its physical stores. Although Walmart’s services are not as diversified as Amazon’s, its stock price has surged, recently pushing the company’s valuation past $1 trillion. Middle-class and upper-income households still turn to Walmart for affordable essential goods.

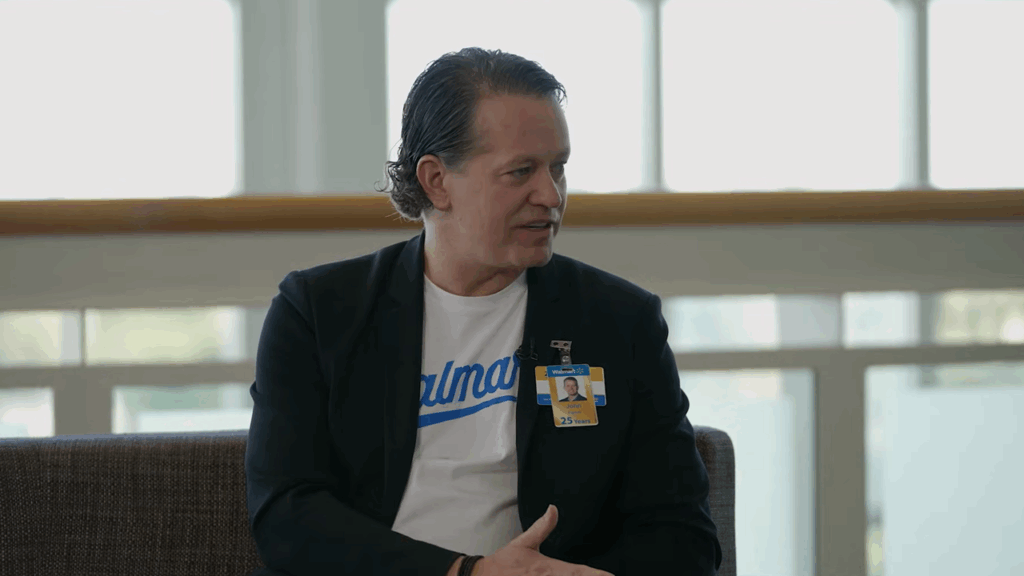

According to Walmart U.S. CEO John Furner, U.S. sales grew 4.6% last quarter, indicating that the company has been adapting well to changing retail dynamics. It is safe to say that Walmart has adjusted effectively and continues to outperform competitors such as Target.

“The pace of change in retail is accelerating,” Furner said, adding, “Our financial results show that we’re not only embracing this change, we’re leading it.”

Ultimately, Amazon beating Walmart in sales for the first time in over a decade highlights how diversified tech-driven business models are redefining global retail. While Amazon continues to benefit from cloud computing, advertising, and subscriptions, Walmart’s resilience shows that traditional retail still holds heft.