In a major move for the entertainment industry, Warner Bros. Discovery (WBD) has officially rejected a takeover bid from the Skydance-Paramount coalition. Announced in the first week of 2026, WBD’s response halts what many analysts expected to be a transformative realignment of the “Big Three” legacy studios.

By turning away from the bid led by David Ellison and backed by his father and Oracle co-founder Larry Ellison, WBD’s leadership seems to prioritize internal stabilization and debt management over the complexities of a multi-studio integration.

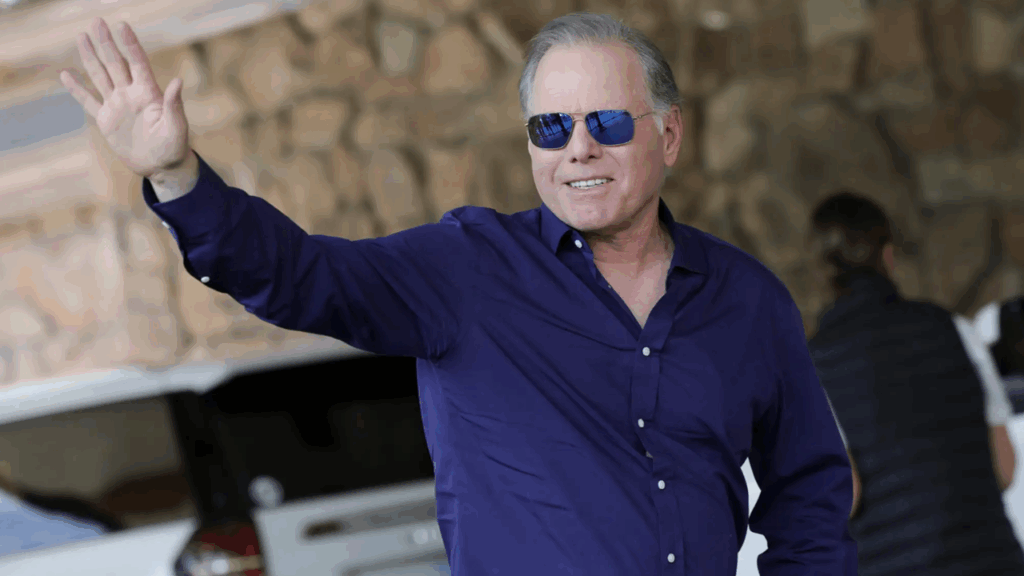

WBD rejects Skydance-Paramount’s bidding offer, led by David Ellison

According to a report by Business Insider, Warner Bros. Discovery (WBD) has officially declined the bidding offer put forth by Skydance-Paramount. The rejection follows weeks of quiet but intense negotiations that had the potential to merge the vast intellectual property libraries of Warner Bros. and Paramount Global under the Skydance banner. Such a union would have created a content titan with the scale to challenge the dominance of Disney and Netflix.

However, sources familiar with the board’s deliberations indicate that the Ellison-led proposal failed to provide a sufficiently compelling solution to WBD’s long-standing debt obligations. Moreover, the board reportedly viewed the valuation as an “opportunistic” attempt to acquire WBD’s premium assets. This includes HBO and the DC Universe. This is indeed an astonishing endeavor at a time when the market remains wary of traditional media valuations.

For WBD CEO David Zaslav, this stance is a pivotal moment in his tenure. Dedicating the last two years to a rigorous cost-cutting regime and a difficult pivot toward streaming profitability, Zaslav appears unwilling to reset the clock for a new era of corporate restructuring. Accepting a merger at this stage would have introduced a fresh wave of regulatory scrutiny and integration risks, potentially derailing WBD’s current momentum.

By choosing independence, Zaslav is essentially betting that the company can thrive by maximizing its existing portfolio rather than absorbing Paramount’s declining linear television assets and their associated liabilities.

Impact of WBD’s rejection on David Ellison’s Paramount

The outcome is a rare setback for David Ellison, who has spent years successfully evolving Skydance from a production partner into a formidable industry player. Despite the “dry powder” provided by Larry Ellison’s fortune, the complexities of merging legacy media empires proved to be a formidable barrier.

Simultaneously, it reflects a trend that has been gaining clout in past decades. The prestige of owning a historic studio is no longer enough to justify a multibillion-dollar gamble if the underlying economics do not provide a clear path to long-term growth.

Industry observers suggest that WBD’s refusal to engage effectively puts the broader media-merger frenzy on hold. While Paramount Global remains a likely target for other suitors, the focus for WBD is expected to shift toward tactical partnerships and “bundling” strategies rather than outright acquisitions. This approach allows the company to remain agile in a landscape increasingly influenced by artificial intelligence and shifting consumer habits without the burden of a messy, large-scale merger.

This decision reflects a broader sense of caution within the entertainment sector. In an environment of high interest rates and fundamental shifts in how audiences consume content, the “bigger is better” philosophy is being replaced by a focus on disciplined autonomy. WBD has chosen a path of self-reliance, leaving the Ellisons and Paramount to reconsider their next move in a fragmented economy. For now, the “Golden Age” of the mega-merger seems to have met its match in the reality of the balance sheet.

Also Read: Jensen Huang Is “Fine” With Proposed Billionaire Tax in California