Warren Buffett has officially handed over the leadership of Berkshire Hathaway to his long-designated successor, Greg Abel. This historic moment marks the end of an era defined by the veteran investor’s six-decade tenure.

At the same time, the transition entails the inception of a new chapter for the $1 trillion conglomerate. As Buffett passes the torch of leadership to Abel, this change is designed to preserve a corporate culture that prioritizes long-term stability and decentralized management.

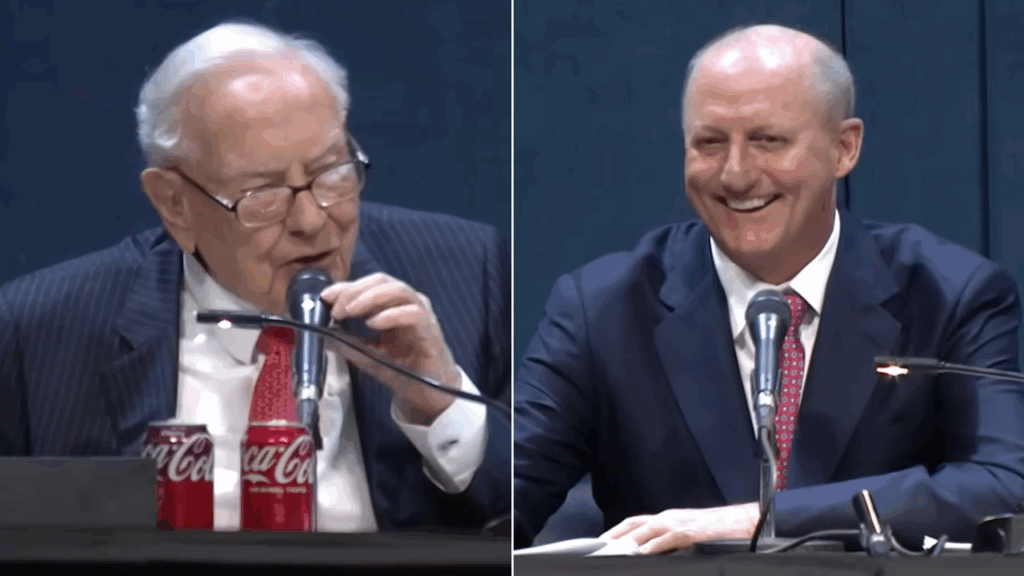

Warren Buffett steps away as Greg Abel becomes CEO of Berkshire Hathaway

According to Business Insider‘s latest report, Greg Abel has finally stepped into the shoes of his predecessor, Warren Buffett, as the new Chief Executive of Berkshire Hathaway. Buffett’s decision to step back was not motivated by a crisis.

As per the report, it was a pragmatic recognition of his age and a desire to see Abel established while he can still offer guidance. This “soft landing” is a rare feat in the high-stakes world of Fortune 500 leadership. In his final communications as CEO, Buffett expressed immense confidence in Abel’s character and capability.

Greg Abel has been a longtime member of Berkshire Hathaway’s energy division, takes the helm with a mandate to maintain the “special sauce” that has made the company a global paragon of value investing. While Buffett will remain an influential figure as Chairman Emeritus, his successor now holds the authority to make the final calls on capital allocation and major acquisitions.

Abel’s ascent is seen as a victory for continuity; he is known for a disciplined, operationally focused leadership style that mirrors Buffett’s own aversion to bureaucratic bloat. For the thousands of employees across Berkshire’s vast portfolio, from Geico to BNSF Railway, Abel represents a steady hand in a world of increasing market volatility.

Related: NVIDIA Launches AI Models For Cars That Can Think Like Humans

New CEO Greg Abel set to uphold the epitome of corporate culture

For investors, the Abel era brings both reassurance and new questions. While the fundamental investing philosophy remains unchanged, Abel will face the challenge of deploying Berkshire’s massive cash pile—which has consistently hovered near record highs—in an environment of high valuations and intense competition from private equity.

Analysts expect Abel to be more operationally involved than Buffett was, potentially seeking more aggressive efficiencies within the subsidiary companies. However, he has stated that the company’s primary goal of being a crucial support for prominent businesses remains non-negotiable.

The leadership shift also highlights a broader cultural evolution within the firm. Abel will be supported by a younger generation of investment lieutenants, Todd Combs and Ted Weschler, who will continue to manage the company’s immense equity portfolio.

This collaborative structure is designed to ensure that no single individual carries the entire weight of Buffett’s legacy. By distributing responsibility, Berkshire aims to prove that its success was never solely dependent on one man’s genius, but on a set of enduring principles that can survive a change in leadership.

As the financial world observes this historic transition, the focus is on the resilience of the Berkshire model. Abel’s first year will be scrutinized for any signs of drift from the Buffett “playbook,” but the early indications suggest a leader who is deeply committed to the mission.

In an industry often criticized for short-term thinking, the Buffett-to-Abel succession stands as a testament to the power of long-term planning and the belief that a company’s culture is its most valuable asset. The era of the “Oracle” may be evolving, but under Greg Abel, the principles of Berkshire Hathaway appear as steadfast as ever.