In a year that has felt like a high-stakes chess match between Silicon Valley and Sacramento, California’s proposed “Billionaire Tax Act” is no longer just a headline—it’s a reality that’s forcing the world’s wealthiest people to rethink where they call home. As 2026 begins, the debate over Initiative No. 25-0024 has shifted from theoretical policy to a crisis of high-level exits and strategic decoupling.

For the people behind the world’s biggest platforms, this isn’t just about a 5% tax; it’s a fundamental change in the cost of residency. The “Billionaire Tax” is a story about the kind of transformation California would experience in the days to come.

The Face of the “Exodus”

Perhaps the most striking evidence of this shift comes from Larry Page and Sergey Brin. According to a Fortune report, for decades, the Google co-founders were the quintessential California success story, but they have recently begun severing deep-rooted ties in response to the Billionaire Tax. Reports show they’ve been moving a network of family offices and business entities, including ventures for influenza research and flying cars, to states like Nevada and Florida.

For someone like Larry Page, a 5% levy on a fortune exceeding $150 billion isn’t just a number; it’s a $7.5 billion bill. However, some analysts warn that the cost could be even higher. As reported by Reason, Garry Tan, CEO of Y Combinator, recently pointed out that because the law treats voting control as a taxable asset, the co-founders could technically face bills of up to $60 billion each, effectively a 50% seizure of their Alphabet shares.

Dilemma for Tech and Business Leaders

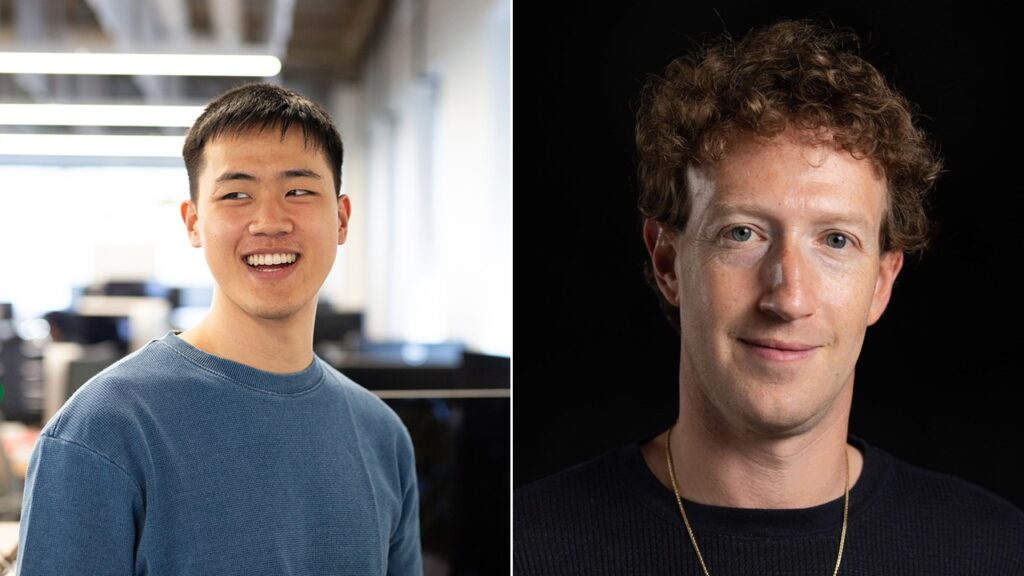

Although the tax is advertised as a modest one-time 5%, the reality for tech entrepreneurs is much more complex. Andy Fang, the billionaire co-founder of DoorDash, recently voiced what many younger founders are feeling: a sense of betrayal. He noted that the tax makes “founder-led companies practically illegal” because it forces them to sell off chunks of their business just to pay the state.

For a founder whose wealth exists almost entirely on paper, being forced to sell off control of their life’s work feels less like a contribution and more like a confiscation. Even Mark Zuckerberg, who remains a Californian for now, faces a staggering liability. While a flat 5% on his wealth would be roughly $9 billion, the Tax Foundation estimates that when factoring in Meta’s dual-class share structure, his total bill could skyrocket to over $76 billion.

In a report by ABC 7, labor unions like the SEIU-UHW and advocates like Senator Bernie Sanders argue that this $100 billion windfall is a moral necessity. They see it as a way to “save the collapse” of California’s healthcare system, protect Medi-Cal, and fund public K-14 schools after federal budget cuts. To them, it’s about those who gained the most finally stepping up to protect those who were hurt the most.

As we move toward the 2026 election, the silhouette of private jets taking off from San Jose International does not simply indicate the mobility of money. It is a sign of a state trying to figure out how to balance its big dreams with the people who have the means to fund them. For millions of Californians, the real question is whether this moment leads to a more equitable future or a “Golden State” that is a little less bright.

Also Read: Larry Page Moves Business Out Of California Due To “Billionaire Tax” Proposition