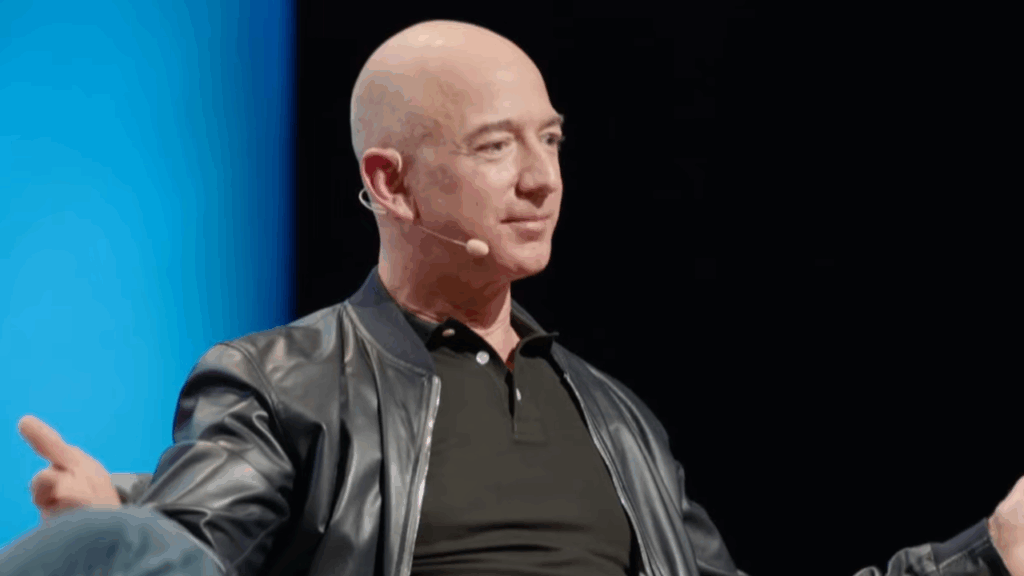

When Jeff Bezos decided to swap the drizzly skies of Seattle for the sun-drenched shores of Miami, he wasn’t just looking for a better tan; he was inadvertently pulling a billion-dollar thread that has begun to unravel Washington State’s financial plans. While the move was framed as a personal return to his roots and a way to be closer to his parents and the operations of Blue Origin, the timing has left a massive, uncomfortable void in the Pacific Northwest’s public purse.

Jeff Bezos’s shift from Miami impacts Seattle’s education budget

Acoording to a Luxury Launches report, Jeff Bezos’s exit from Miami has direly affected the education budget of Seattle. For years, Washington banked on a small, elite group of billionaires to help fund its social ambitions. The centerpiece of this strategy was a new 7% capital gains tax, specifically designed to funnel wealth from massive stock sales into the state’s Education Legacy Trust Account. The goal was noble: providing better childcare and leveling the playing field for K-12 students. However, the plan had a single, glaring vulnerability. It relied heavily on the residency of a few individuals who had the means to live anywhere in the world.

By the time the legal dust settled and the state’s Supreme Court upheld the tax, Bezos had already signaled his exit. His move to Florida, a state that famously has no income or capital gains tax, effectively shielded his massive liquidations of Amazon stock from the reach of the Evergreen State.

Analysts estimate that by simply updating his address, Bezos saved himself nearly $1 billion in state taxes on his recent stock sales. To put that in human terms, that single “savings” figure is larger than the total amount the entire state collected from everyone else through that same tax in its first full year.

Related: Jeff Bezos Advises Gen Z Entrepreneurs To Gain More Experience First

The ripple effect in Olympia has been both immediate and humbling. In January 2026, Governor Bob Ferguson was forced to unveil a supplemental budget that addresses a staggering $2.3 billion shortfall. To bridge the gap, the state is now having to consider painful measures.

This includes tapping into the “rainy day” fund, making steep cuts to agencies, and potentially delaying the very education programs the billionaire tax was supposed to protect. It’s a stark lesson in “concentration risk,” the idea that depending on one or two people to fund a society is a bit like building a house on a single pillar.

There is a deep irony in the situation. The tax was created to ensure the wealthiest citizens contributed more to the communities that helped build their empires. Yet, the pressure of that very tax seems to have encouraged the wealthiest citizen of all to depart. For the average resident, it raises a frustrating question about fairness and mobility. While a middle-class family can’t easily pack up their lives to avoid a tax hike, the ultra-wealthy can, and do, move their entire worlds with the stroke of a pen.

As Washington’s lawmakers sit in the state capitol this session, they are facing a future that looks a lot leaner than they expected. The departure of Jeff Bezos has not bankrupt the state, but it has certainly bruised its confidence. It serves as a very human reminder that policy doesn’t exist in a vacuum. When the math of a state budget relies on the personal choices of a single neighbor, that neighbor’s moving truck becomes a matter of public concern.

Also Read: 15 Most Expensive Things Owned by Jeff Bezos