During NVIDIA’s company meeting last week, Jensen Huang expressed an important sentiment regarding the global market. November 20 witnessed a sharp rise in the firm’s stock value by roughly 3 per cent. However, the next day saw a sudden dip in the gradient as confidence in AI trading continues to remain volatile. To the NVIDIA CEO, “the market did not appreciate” the company’s “incredible” quarter.

At the company meeting, Huang enforced the idea that speculations surrounding AI bubble rely heavily on how NVIDIA performs in the market. An increase in earnings would signify that the bubble has a long way to go. However, a drop in the stock value would indicate otherwise.

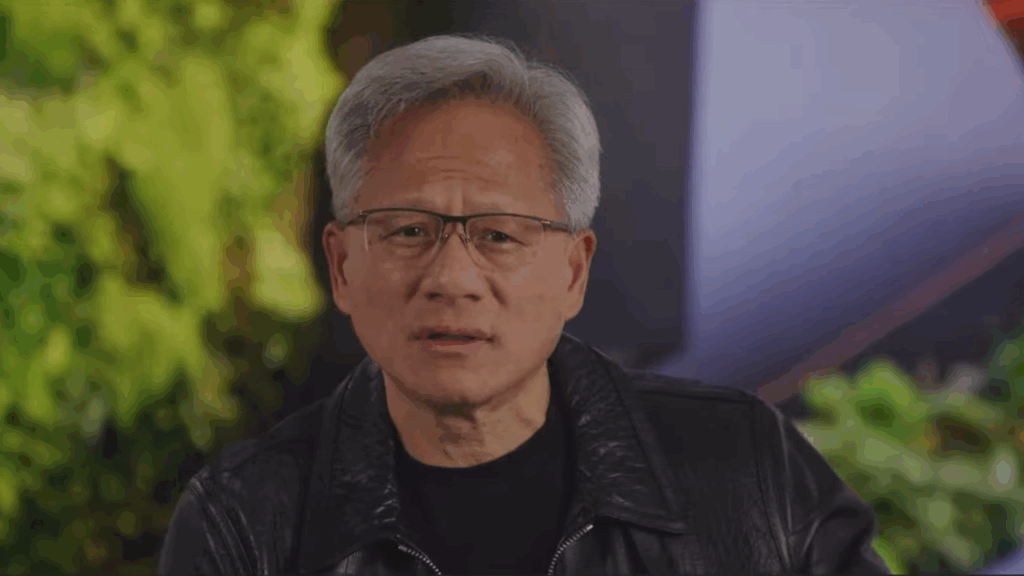

NVIDIA CEO Jensen Huang talks about company’s “incredible” quarter

As per a November 2021 report by Business Insider, Jensen Huang spoke to his team during a meeting last week regarding NVIDIA’s earnings in the past quarter. The chief executive stated that the market did not acknowledge the “incredible” earnings made by the company in the recent quarter.

This spike in the stock value was triggered by Huang’s confident dismissal of an AI bubble collapsing in for the AI tech industry. However, the sudden change in value that happened exactly a day later prompted the CEO to make an important remark.

According to the details listened to by Business Insider, Jensen Huang stated, “If we delivered a bad quarter, it is evidence there’s an AI bubble. If we delivered a great quarter, we are fueling the AI bubble.” In other words, the NVIDIA CEO made it clear that the boom or bust of the AI bubble depends greatly on how the GPU manufacturing company fares in the global market. As per the report, Huang believes “said the expectations for Nvidia were so sky-high that the company was in somewhat of a no-win situation.”

Simultaneously, Huang also acknowledged the kind of influence NVIDIA has exerted in terms of economics. “If we delivered a bad quarter, if we’re off by just a hair, if it just looked a little bit creaky, the whole world would’ve fallen apart,” Huang said. In the same context, he assured, “We’re basically holding the planet together — and it’s not untrue.” The CEO then added that NVIDIA’s progress is helping the U.S. avoid the possibilities of a recession.

Related: NVIDIA CEO Jensen Huang Doesn’t Believe in AI Bubble, Company Shares Hint Otherwise

Does the AI bubble really depend on NVIDIA’s performance in the market?

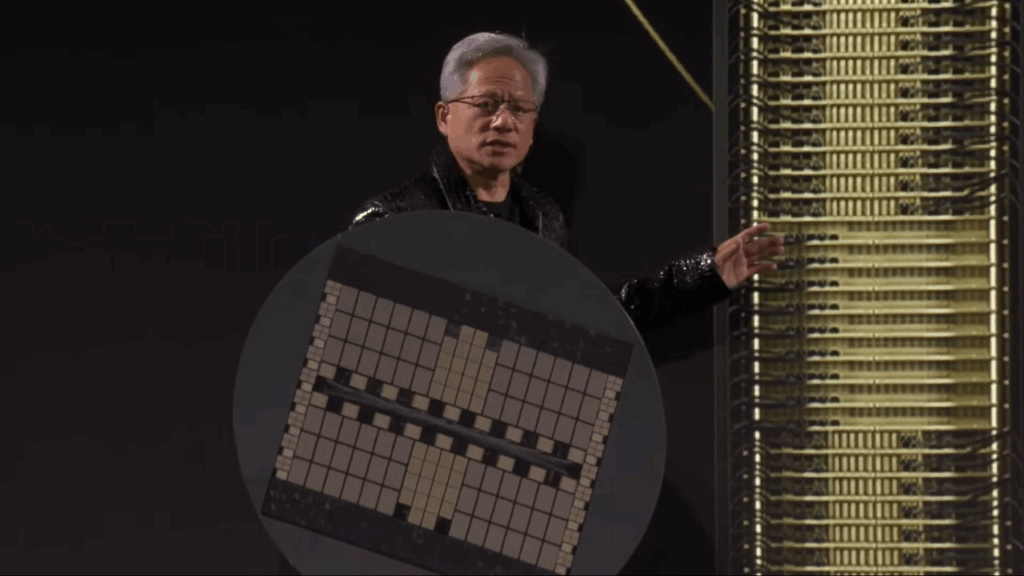

Jensen Huang is quite right about the degree of influence NVIDIA has over the world market. Being the biggest GPU and chip manufacturing organization across the globe, most of the major AI companies depend on NVIDIA’s AI chips to build their data models.

The centrality of NVIDIA, therefore, gives them as much attention as the amount of stress the company finds itself in. As per the Business Insider report, Huang stated in the meeting that “Nvidia’s massive influence has made expectations harder to meet — something that has also played out in its market value.”

Many tech experts, executives, and entrepreneurs have expressed that the investments made in AI technology are immensely high at the moment of writing. Yet, the same companies are failing to meet the high demands of the users since they have to make greater progress in building more advanced data models to run AI assistants with higher efficiency. Thus, Huang prioritizing the company’s work productivity over concerns regarding the AI bubble collapse is perhaps the best course of action for AI companies to opt for.

Also Read: Siemens CEO Turns Workout Routine Into Comic Strip To Encourage AI Use